Discover why entrepreneurs are choosing Poland as their go-to destination for business expansion!

Poland stands out with several compelling advantages:

- Tax System: Enjoy an optimal level of tax burden among EU countries. Small firms (with annual turnover up to €2 million) benefit from a 9% corporate income tax (CIT), while others have a 19% rate. Plus, you can get a real money refund for overpaid VAT. Since 2021, Poland has introduced a tax settlement on distributed profits, meaning you only pay CIT on the profit that is taken out of the business, not on reinvested earnings.

Geographical Location: Poland’s prime transit and logistics position acts as a bridge between Western and Eastern Europe, facilitating a high volume of cargo flows and opening up a broad spectrum of business avenues.

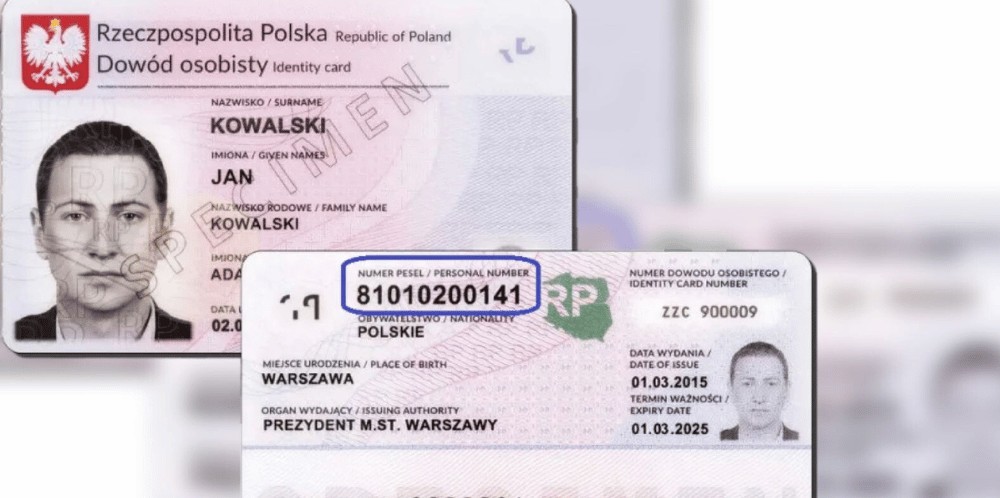

Business Setup Accessibility for Foreigners: Almost any foreigner can establish a company in Poland with just their passport. Remote business registration allows founders or company heads to set up their enterprise without being physically present in Poland.

Low Company Maintenance Cost: Poland boasts the lowest company maintenance costs in the EU. Virtual office rent is around €330 per year, with accounting support starting from €130 per month.

Labor Market Access for Foreigners: Hiring foreign workers in Poland is hassle-free, allowing your Polish company to smoothly onboard employees with all necessary work permits, which can also be processed remotely. Poland offers one of the most liberal employment regimes for foreigners in Europe.

Access to the EU Market: Opening an LLC in Poland not only provides better access to the national market of approximately 38 million consumers but also to the broader EU market, encompassing around 550 million consumers.